August 2, 2018

How Utilities Can Use Machine Learning for Bad Debt Control

Bad debt control can be considered a use case under the umbrella of revenue protection. It can result in hard dollar value, making it easier to show the benefits of the project. Different types of revenue protection projects, such as power theft, unaccounted energy, fraud, and bad debt require different methods to identify the issues. The majority of approaches are rule based detections, however, others use machine learning models. For example, a machine learning model can be used to generate credit risk scores for customers. The generated score can then be integrated to the operational process to help reduce bad debt. This use case demonstrates how machine learning can help a utilities company protect their revenue.

Bad debt is inevitable, but the better it can be managed, the more profit a company can make. Especially in the utilities industry, identifying high risk customers is of great importance. Typically, utilities will use the credit score from the external credit bureaus, namely Equifax, Experian, and TransUnion, to evaluate if the customer is high risk. For high risk customers, a high deposit will be requested at the time of enrollment, or a more aggressive collection strategy will be applied when the bill is past-due. This is a good practice for all utility companies, and it has traditionally worked very well, but is a universal credit score good for all? No. Further, especially in more competitive markets, companies may like to go beyond the generalized score. Utilities recognize that revenue and bad debt always go hand in hand. Therefore, better identifying customer credit risk provides two benefits. It not only helps reduce the bad debt, but contributes to revenue growth by increasing the eligible customer base in the enrollment process through decreased misclassification.

Why is a custom developed credit risk score better? First, utilities are a special type of service; considered essential in a modern world, facilities provided by utilities have a huge impact on people’s behavior. Since the universal credit score from a credit bureau is not tailored for utilities, it does not reflect the real credit risk in terms of using utilities. Due to the high number of interactions utilities have with their customers, utility companies have access to a lot more data than credit bureaus do, such as customer payment history, contract history, communication, interaction with call center, use of web/mobile app, usage pattern, etc. All this data allows for more analysis and better predictions can be developed.

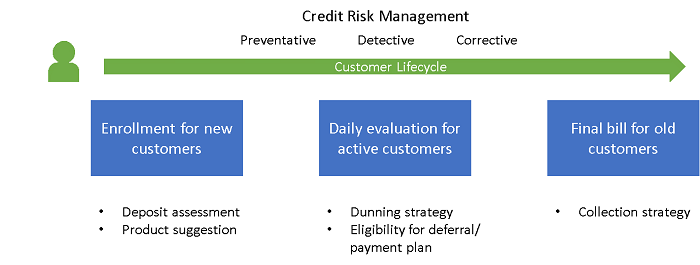

Utegration has developed 3 different models for credit risk scoring used at different stages of the customer life cycle. Since the scoring process is tightly integrated with the operational system, the operational processes use the score to manage the credit risk of the customers. First, a model is developed for new customer enrollment. At this stage, since there is not any customer data yet, the data used to build the model is mainly from the credit report of the customer from the credit bureau. The score is calculated in real time at the time of enrollment, and based on the score, the company will determine if and how much of a deposit is required for the customer, and which products need to be recommended to the customer. Second, the credit risk score can be calculated for all active customers through a batch process, and then data will be integrated back to the billing system. Depending on the credit risk of the customer, different dunning strategies will be applied, and when deferral or payment plan is requested, it will be used to determine if the customer is eligible. At this stage, the data being used for the model is mainly the utilities’ own data. Finally, a model is developed with the final bill when the customer moves out, with the score as an indicator of how likely the customer will be to pay their final bill. The score will be sent to the collection agency with the other data, and a collection strategy will be determined.

Overall, this model yields positive results. Not only does the performance of the credit risk score with historical data show a significant improvement when compared with the universal credit risk score, but the continuous validation in the real world, after deployment, continues to ensure accurate results.